In this article, you’ll learn which are the most reliable WooCommerce payment gateways, how you can reduce recurring costs and frauds and what factors to consider while implementing payment gateways to grow sales. Read on and get started!

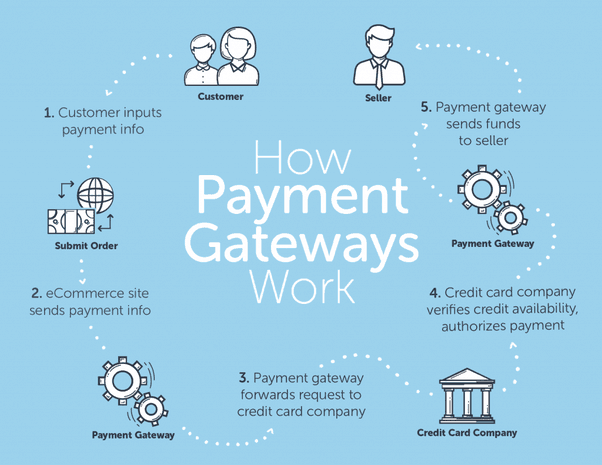

What is a payment gateway? How payment gateways work?

In simple terms, payment gateway authorizes payments between your customers, their card company and your bank. It allows your customers to enter their payment details and pay for the products you sell on your WooCommerce or any eCommerce store.

Here’s how payment gateways work

- Customer places an order and submits their payment details.

- Payment details are sent from your WooCommerce site to the payment gateway.

- Payment gateway forwards request to the customer’s lender (bank, credit card, etc.)

- The lender verifies the availability of funds and authorizes payment through the gateway.

- Payment gateway deposits funds into your account.

Good payment gateways should be fast, easy to integrate, affordable, and use the latest encryption technology to ensure your customers’ data is secure throughout the entire payment journey.

Why is it important to have a payment gateway?

Just consider this:

You have an excellent website, excellent products and excellent marketing.

But when it comes to the crucial checkout step – entering card details, users abandon your website.

This situation is like you held the morsel in your hand, but you couldn’t taste it. All that sweat and money were wasted!

Why?

Because of wrong payment gateways.

Look. Payment gateways are the one using which customer will pay you. So if they don’t see trusted or popular gateways, they will abandon.

You will not be able to use all payment gateways. Choosing the right ones will help to boost sales while choosing the wrong ones will hurt them. You need to strike an optimum balance that brings the best value at the lowest cost.

So to achieve that optimum balance, these key points below will guide you to choose the best payment gateways for your WooCommerce store.

Top ten factors on how to choose a WooCommerce payment gateways

While the WooCommerce payment gateways page lists down four major points, we added a few more that are worth considering.

Cost and fees

Now, each payment gateway charges differently. Some have an initial set-up cost while some allow free set-up.

But every gateway will charge you a transaction fee and a fixed cost charged for every sale you make. There are monthly or yearly fees as well.

What’s more? Transaction fees also change depending on where you sell – within the U.S. or outside it.

Generally, if you’re selling high-priced items, you want to lower your percentage transaction costs. And if you’re selling low-priced items, you want to reduce your fixed costs.

In the end, it boils down to choosing a payment gateway that fits your business model.

Frauds, risks, chargebacks

You can’t avoid refunds but you can minimize them.

Certain locations have higher fraud rates. Certain payment gateways make it very easy for customers to raise disputes. As a result, you end up losing more money than you make from that sale.

Hence, you should disable these gateways to reduce your risk and worries.

Location

Payment gateways are sometimes only available in selected countries and local customers feel more comfortable transacting with that payment gateway.

Therefore, enabling the gateway seems a worthwhile investment if you are selling locally. If not, you should ignore it.

A good thing is WooCommerce provides a country filter in the extensions store so that you can check which payment gateways work in your country.

Trust, security, PCI Compliance

Obviously, customers won’t purchase from you if a payment gateway is unknown to them or your store isn’t secured.

That’s why most payment gateways require you to have a Secure Socket Layer (SSL certificate). This ensures that all communications between your site and customers are encrypted and secure.

Additionally, you should also make sure your site is covered by the Payment Card Industry Data Security Standard (PCI-DSS).

These apply to all organizations that handle credit card transactions. Also, check the gateway’s compliance page to find out their PCI Service Provider level.

- Level 1: Processing > 6 million card transactions per year. This is the most stringent level.

- Level 2: Processing 1 to 6 million transactions per year.

- Level 3: Processing 20,000 to 1 million transactions per year.

- Level 4: Processing < 20,000 transactions per year.

Gateways with the highest security levels will also include 3-D Secure as an extra layer of authentication. This help minimize fraud.

Subscriptions

If you’re selling subscription products, you’ll need a payment gateway that supports automatic recurring payments.

But, due to additional security measures associated with storing customer payment information, not all payment gateways support it.

However, major WooCommerce payment gateways like Square, Stripe, PayPal and Amazon Pay support subscriptions.

WooCommerce users also have the option of using the WooCommerce Subscriptions plugin. It supports both automatic and manual types of recurring payments.

List of payment gateways that supports automatic recurring payments

Integrated vs hosted

An integrated gateway performs all authorization on your WooCommerce website like yourstore.com/checkout (customers won’t get redirected elsewhere…like in case of Stripe).

While a hosted one takes the customer offsite to complete their transaction (such as yourstore.paymentgateway.com) before sending them back to your site to view a confirmation page.

These might be annoying for a few customers, but there are hosted sites that are also secured (like PayPal Payments).

Most popular payment processors support integration with WooCommerce, so research well.

Volume pricing

For large stores, setting up your own merchant account is a deal-breaker. You can negotiate better transaction fees and volume pricing.

Using one payment processor makes this easier. A gateway with a volume pricing discount will lower your transaction fees as your volume of sales increases.

Merchant account requirements

If you own a retail store, you probably already have a merchant account.

However, Stripe and PayPal no longer require you to open a merchant account. Instead, these aggregators use a single merchant account for all of their users, making payment management easier by creating an all-in-one account.

Multi-currency processing

Even if the majority of your customers are local, finding a payment gateway that can handle different currencies will let you eventually expand into foreign markets.

There is no doubt that customers feel safer and more comfortable buying from you if they can use their local currency. And there are some gateways that do handle different currencies.

In addition, customers save time by not having to calculate exchange rates.

Single vs multiple payment gateways

Using only trusted and popular gateways like PayPal is a good option. But that doesn’t mean you shouldn’t expand your gateway selection.

If an alternative option is available in the event of a breakdown, then it is a safe bet, such as using both PayPal & Stripe.

But also don’t overload customers with choices. Also, take into consideration where you sell the most. Three to four gateways is a fair option.

When you consider all the above ten points, you’ll gain confidence in selecting the most appropriate payment gateways.

That said, let’s see the best WooCommerce payment gateways you can implement on your websites.

Top WooCommerce payment gateways – pros, cons and pricing

Whether you’re going with single or multiple gateways, you’ll want to choose from those that are already popular among consumers.

PayPal

With 400+ million customer accounts, availability in over 200 countries and support 25 currencies, PayPal is the most popular and most widely used WooCommerce payment gateway. Easy to set-up, and the gateway doesn’t require sellers to have a separate merchant account.

Earlier, with WooCommere installation, you would get the PayPal Standard payment gateway. With WooCommerce version 5.5.0 onwards, PayPal Standard is hidden for new installations.

But this won’t affect existing stores. WooCommerce encourages PayPal Standard users to use the PayPal Payments extension which is their full-stack solution (credit card processing, PayPal checkout, subscriptions, pay later options, etc).

PayPal Payments

This is PayPal’s latest, all-in-one checkout solution developed by the WooCommerce team. It is free to download.

Pros

- Customers are redirected PayPal’s secure site to finish the transaction.

- Multi-currency support

- Supports recurring payments

- Paypal fraud detection

- Supports automatic rebilling for failed subscription payments. This means rebilling can issue another charge at a later date, increasing your chances of winning back lost revenue.

- Offers Pay later options

- Offer country specific payment methods

- PayPal provides two different card processing options

Cons

- Customers getting redirected to PayPal’s secure site is also considered as a limitation, as it could impact the flow of the customer purchasing experience.

Pricing

- 2.9% + $0.30 per transaction (within US)

- 4.4% of the transaction amount. Plus, a fixed fee based on the currency. (outside US)

Learn more about PayPal Standard pricing

Stripe

This is another very popular and rapidly growing payment gateway. Stripe is built with mobile in mind — supporting Apple Pay and Google Pay — as well as other payment gateways around the world. Currently, the service accepts credit and debit cards in more than 135 countries.

Stripe is easy to set up and also supports one-click checkout.

Here’s how to enable one-click checkout for Stripe.

Pros

- Customers stay on your WooCommerce store during checkout. They aren’t redirected elsewhere.

- Extremely developer friendly

- PCI-DSS compliant

- Process refunds from your WooCommerce dashboard

- Support recurring payments and automatic rebilling for failed subscription payments.

- Multi-currency support

- Faster checkout support on mobile and desktop

- Fraud detection support with 3D secure

- Instant payouts with quick installation and setup

Cons

- Transactions are automatically converted to your local currency. This is a big drawback for businesses wanting to hold multiple currencies and convert them at a later date.

Pricing

- No initial cost or setup fee.

- 2.9% + 0.30$ per transaction (within US)

- Add 1% for international cards and 1% for currency conversion if required.

- Limited functionality for in-person retail businesses and restaurants.

Learn more about Stripe pricing

Amazon Pay

Yes. Amazon is also in the payment game. It’s a master at improving checkout experience and Amazon Pay just leverages it.

Customers can log into their Amazon accounts to make a payment without leaving your website (transactions take place via Amazon widgets), giving you more control over their experience. No need for them to create an account on your store, or check out as a guest.

Pros

- Amazon Pay supports recurring payments through WooCommerce Subscriptions and offers volume pricing options.

- Supports automatic rebilling for failed subscription payments

- Amazon-proven fraud protection and detection technology

- Mobile-optimized widgets for tablets and smartphones.

- Multi-currency support

Cons

- Recurring payment support for WooCommerce Subscriptions available for USA, UK, Germany, France, Belgium, Cyprus, Sweden, Portugal, Hungary, Denmark, Japan, Italy, Ireland, Spain, Luxembourg, Austria and the Netherlands.

- Like Stripe, while you can charge in multiple currencies, these are automatically converted to your local currency.

Pricing

- 2.9% + $0.30 per transaction (within US)

- However, there are no set-up costs.

Know more about Amazon Pay pricing

Square

WooCommerce team have developed the Square plugin. Like the rest of the payment gateways mentioned, Square also accepts all major debit and credit cards.

Square integrates its inventory management system with WooCommerce. When someone buys an item from you, the inventory is automatically synced between the two.

If you sell products or services in a physical store in addition to your eCommerce store, Square could be a great option as you can integrate your physical and online sales into one central hub.

Pros

- Allows you to accept payments directly on your store for web and mobile.

- Customers stay on your store during checkout instead of being redirected to an externally hosted checkout page.

- Chargeback protection and fraud detection.

- PCI-Compliance with zero fees.

Cons

- No out of the box integration with WooCommerce Subscriptions – you may need to purchase an additional plugin.

- Only available in eight countries – the U.S, Canada, Australia, Japan, UK, France, Spain and Ireland.

Pricing

- 2.6% + 10¢ for contactless payments.

- No setup costs and charges on an individual transaction basis

- It takes up to two business days to receive the funds.

Know more about Square pricing

Authorize.Net

Authorize.Net is a payment processing platform designed to make transactions as simple and secure as possible. It is a leader in payment security. And also one of the oldest and most trusted payment gateways.

Pros

- It’s Accept.js API is designed to capture a customer’s payment data before it is passed to your server — processing it instead through Authorize.Net. That keeps your customers’ personal data safer.

- Accepts payments from all major credit cards and digital payment options like Visa Checkout, Apple Pay, and PayPal.

- Supports WooCommerce subscriptions and pre-orders.

Cons

- Not available in Asia and Africa.

- Accepts only seven currencies.

Pricing

- $79 download cost

- 2.9% + 0.30$ per transaction

View more on Authorize.Net pricing

Braintree

Braintree supports WooCommerce subscriptions. The gateway lets you accept credit cards and PayPal payments on your WooCommerce store via Braintree.

Pros

- Accept all types of credit cards, wallets including Android Pay, Apple Pay, Google Pay and more.

- Supports over 130 currencies

- One-touch payment, support for digital wallets

- Customization options for failed transaction management, pricing plans, discounts, automatically prorated subscriptions.

Cons

- Does not handle currency conversion, instead your customers are charged in your accounts currency and the customers bank handles the conversion and associated fees.

- Considered less secured compared to other payment gateways.

Pricing

- 2.59% + $.49 per transaction

- No set-up cost

View more on Braintree pricing

2Checkout

The 2Checkout payment gateway is entirely compatible with WooCommerce. By installing this plugin, you can accept payments from clients all over the globe.

Pros

- Includes PayPal direct Checkout. 2Checkout makes checkout easy by letting them skip the billing and shipping steps.

- The automatic calculation of all taxes like VAT in different countries around the world is very impressive.

- Support up to 87 different currencies and up to 15 languages.

- Supports recurring payments

- Easy to set up and integrate, intuitive, everything’s well documented

Cons

- Not good for high-risk merchants

- Platform not so flexible, some capabilities missing.

- Higher rates compared to alternatives

Pricing

- Pay-as-you-go model.

- The lowest plan charges 3.5% + $0.35 per transaction

View all 2Checkout pricing plans

Direct Bank Transfer, COD, Cheque Payments

While card payments account for the vast majority of online purchases, they’re not the only payment method available.

For example, in local markets, COD or Cash on Delivery is preferable while for very high value orders, it’s common for people to use Direct Bank Transfer (BACS) or Cheque Payments.

Other popular payment gateways – Alipay, SagePay…

Alipay is a mobile payments giant in China. If you want to target Chinese users through your online store, integrating Alipay is a must.

As far as features go, Alipay is up to par with the other payment processors covered so far. Likewise, you can easily integrate it with WooCommerce using extensions such as Alipay Cross Border Payment Gateway.

Like Alipay is for China, SagePay for UK. Powerful, secure, feature-rich.

Phew! That covers almost all the most popular ones used worldwide.

Well, now let’s see how restricting these payment gateways can get you more sales

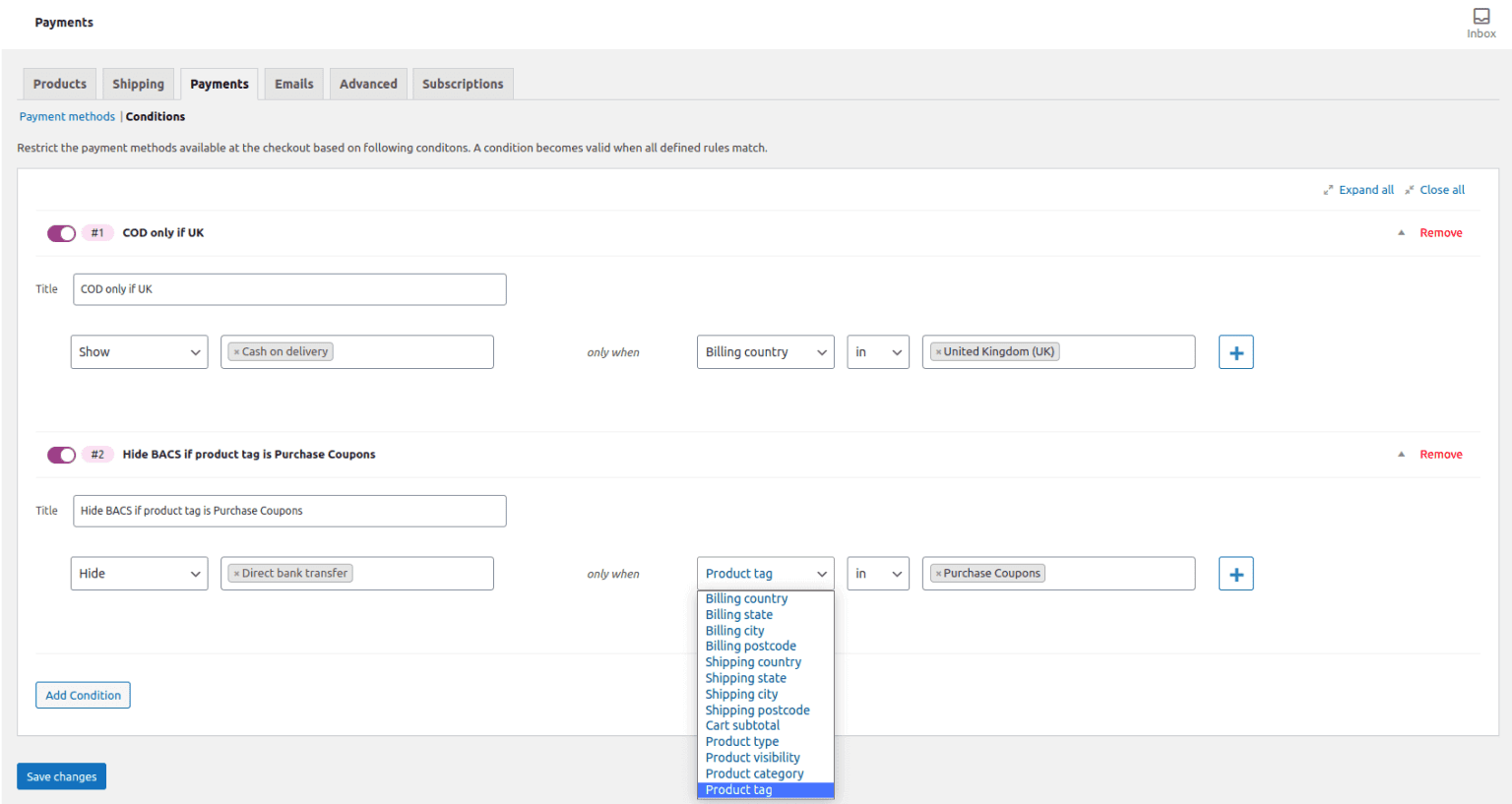

I guess you now have a fair idea why to show or hide certain payment gateways on your WooCommerce store.

But do you know there’s a very easy way to show/hide a particular payment gateway!

That’s using Conditional Payment Methods for WooCommerce plugin.

The plugin developed by StoreApps can be purchased on WooCommerce.com.

Using this plugin, you can show/hide available payment methods based on customer’s billing or shipping address – country, state/county, city or postcode, or order total or product taxonomy. Get full control as to which payment method to be shown / hide for each country.

Major benefits of using Conditional Payment Methods for WooCommerce plugin

- Simple set-up, easy-to-use

- No coding or customizations required

- Restrict based on products in cart – recurring subscriptions / virtual products, etc. (Coming soon)

- Conditional rules based on customer’s “geo-location” based on IP address (Coming soon)

Get Conditional Payment Methods for WooCommerce

Pro-tips to grow sales by restricting payment methods

Every country has its own tax rates, fees, billing infrastructure, currencies, preferences for particular payment methods or gateways.

So based on these conditions, enabling or disabling a particular payment method will help you cut down on losses. And customers will select the one they prefer and complete the checkout.

- If you are selling worldwide, have two major payment gateways – Like PayPal & Stripe or PayPal & Authorize.Net along with other low cost options.

- Disable gateway like Stripe for non-local customers and enable a specific gateway that is widely used in that country. For example, Alipay in China, CCAvenue in India, etc.

- Enabling Apple Pay is also a good choice if you have high-end customers and sell worldwide. Apple Pay for WooCommerce is currently enabled via Stripe Payments.

- If you sell majorly in the United Kingdom, enable SagePay on your store. It is a widely used payment gateway there along with other popular ones.

- If your maximum paying customers are from Australia, Canada, Japan, UK and the United States, enable Square payment gateway.

- Payment Gateways like Stripe & Amazon Payments are not used in African countries. Disable them if people from these countries buy your products.

- Allow Direct Bank Transfer only when the order total is higher. Say above $1000. This will allow you to save on fees and avoid chargeback later.

- For selling subscriptions, it is advisable to show Square, Stripe, PayPal that supports automatic recurring payments.

- Not just gateway, customer also prefer to pay in their own currency. So enable gateways like Stripe or PayPal that supports multi-currency.

- For small order total, enable Cash on Delivery. Similarly if you sell in rural markets or where the majority of transactions are in cash, Cash On Delivery is a good option.

- Don’t allow credit card payments for some specific countries, cities, and zip codes where chances of frauds are more.

Conclusion

Payment gateways play a critical role in the checkout stage.

Restricting payment gateways will surely help you win customers’ trust, which will result in more repeat sales, easier checkout experience, and fewer abandonments.

Oh yeah, don’t forget to use Conditional Payment Methods for WooCommerce plugin. It’s easy, powerful, valuable. And you’ll have great conversions.

Feedback, suggestions, comments? Share your thoughts below!

FAQs

How much does WooCommerce charge for credit card?

WooCommerce is an open-source e-commerce platform, and they don’t charge a fee for credit card transactions. Instead, they recommend using payment gateways like Stripe, PayPal, or Square, which have their own pricing structures for credit card processing fees.

How do I integrate a payment plugin into my WooCommerce store?

- Choose a payment plugin that is compatible with WooCommerce and meets your business needs.

- Install and activate the payment plugin in WordPress. You can do this by going to Plugins > Add New in your WordPress dashboard.

- Configure the settings of the payment plugin. This will usually involve entering your payment gateway account details and setting up any necessary payment options.

- Test the payment plugin to ensure it is working correctly. You can do this by making a test purchase on your store.

- Once the payment plugin is working correctly, make sure to update your store’s payment settings to enable the new payment option.

- After enabling the payment option, make sure to test

What is the default payment gateway for WooCommerce?

The default payment gateway for WooCommerce, which is a popular e-commerce platform built on WordPress, is called “WooCommerce Payments” (formerly known as “WooCommerce PayPal Powered by Braintree”). It is a payment gateway provided by WooCommerce and offers integration with PayPal and Braintree as the underlying payment processors.

This default payment gateway allows merchants to accept payments through PayPal, credit cards, and other payment methods supported by PayPal and Braintree. However, it’s important to note that the default payment gateway may vary depending on the specific version and configuration of WooCommerce, as well as any additional plugins or extensions installed by the merchant.

Can I use multiple payment gateways on WooCommerce?

Yes, you can use multiple payment gateways on WooCommerce. WooCommerce allows you to easily integrate with various payment gateways such as PayPal, Stripe, Square, Amazon Pay, and more.

That’s all fairly cool, but I can’t restrict the stripe Apple Pay integration over a certain transaction amount using Conditional Payment Methods for WooCommerce. ie I’d like the Apple Pay button to disappear for transaction amounts over $2000 and show only wire transfer (BACS) option. Would be great if I could do that easily.

Hi Joe,

If you are referring to WooCommerce Stripe plugin, then Stripe plugin treats Apple Pay as an integration, and not as a separate payment method. So you would need to restrict the entire Stripe payment gateway.

To implement your use case, set up these two different conditions:

I hope this helps.